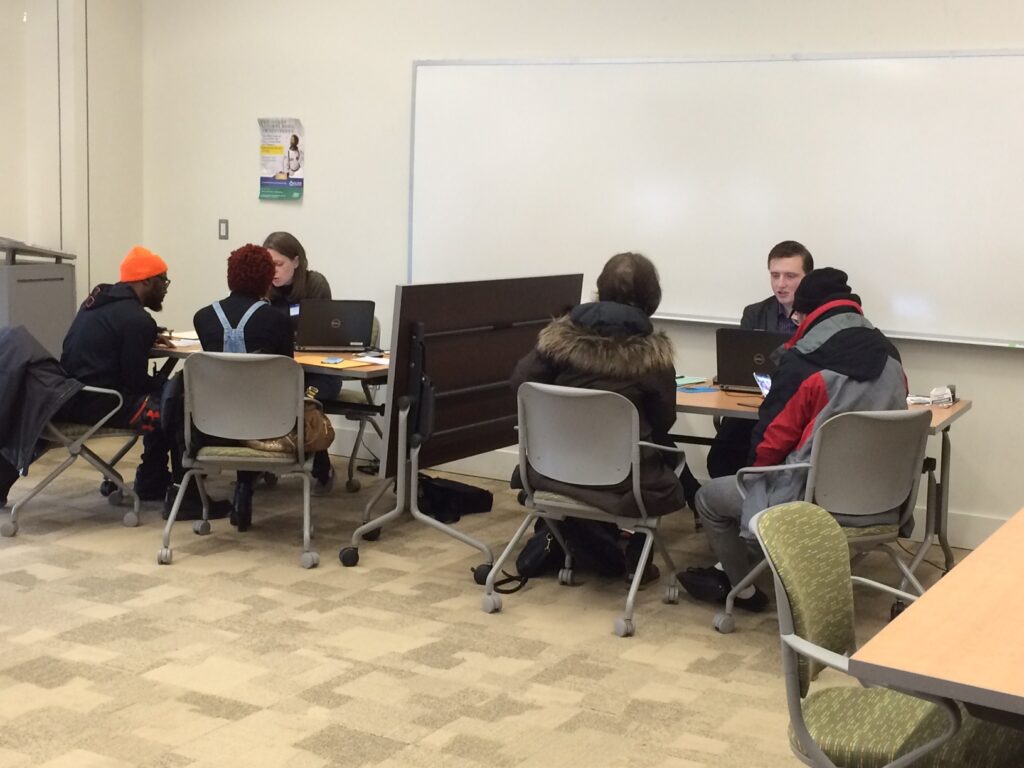

Tax season can be a stressful time for just about everyone. But a group of UMBC students and staff members worked tirelessly for six Saturdays during the spring semester to ensure that 106 clients, mainly from Baltimore County and Baltimore City, had an opportunity to receive free tax preparation to file their taxes before the April deadline.

The Volunteer Income Tax Assistance Program (VITA) is facilitated by the IRS and is offered at locations throughout the country. It offers free tax preparation to people earning $54,000 or less, people with disabilities, and limited English speaking taxpayers who need assistance in preparing their own tax returns. The program came to UMBC for the first time this year when several people at the university who had worked as VITA volunteers in the past came together and identified a need for the service in the local community.

“We could have quadrupled the number of clients we saw and still not served everybody that wanted it,” says Trisha Wells, director of student affairs administrative and business services and organizer of the UMBC VITA program.

Wells worked with Meghann Schutt, deputy director of the Shriver Peaceworker Program, the UMBC Financial Literacy Team, the Career Center, the Department of Economics, and many other groups on campus to bring the VITA program to UMBC. Volunteer recruitment started last fall, and a group of dedicated students went through a tax certification class to help serve community members in need.

“I think most people don’t understand that taxes can be used for social justice,” shares Ethan Griffin ’18, a Sondheim Public Affairs Scholar majoring in interdisciplinary studies and UMBC VITA student volunteer. “Everyone has to do it and most may not understand the inequity…it’s really uplifting to be able to step in during the process and offer help to as many people as we can.”

Wells says that the first year of the program was a tremendous success, with 83 percent of clients served receiving a refund and almost $126,000 in total refunds for the program. Almost two-thirds of the clients who received refunds said they planned to use it to pay off debt, pay past due bills, or save and invest the money.

Wells notes that the enthusiastic student involvement in the program was what really drove its success in its first year at UMBC.

“Their energy is what made it happen,” explains Wells. “There is no way that we would ever get enough preparers if we weren’t leveraging students. The clients loved working with students. The person getting their taxes done feels like they are making a difference in the student’s life and it’s a give and take and they get to know each other. The students being a part of this is crucial.”

The UMBC VITA program partnered with the Baltimore CASH Campaign to get the word out in the local community that this service was available at the university. Because there is such a significant need for the VITA service in the local community, Wells is hopeful that even more volunteers will sign up for training next year to be able to serve a larger number of clients.

Griffin also has advice for fellow students, faculty, and staff who might be interested in getting involved next year.

“VITA can be for anyone, not just those interested in the tax process or financial economics,” he says. “I think the dynamics and assets of the [UMBC VITA] site make the service, your service, connected to those across Maryland and even the country.”

Anyone who might be interested in getting involved in the program next year is encouraged to contact Trisha Wells at twells@umbc.edu.

Top image: IRS 1040 Tax Form. Photo by Ken Teegardin, CC by -SA 2.0. Bottom image: UMBC student volunteers assist community members with tax preparation as part of the VITA program. Photo courtesy Trisha Wells.

Tags: CAHSS, Economics, INDS, PoliticalScience, ShriverCenter, SondheimScholars, staff, StudentAffairs